capital gains tax increase 2021 uk

The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic. Following Uncle Sam and What It Means for UK Entrepreneurs.

Airport Security Market Size Share Forecast Report 2022 2028 Airport Security Marketing Perimeter Security

Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years.

. In the budget announced on Wednesday he revealed corporation tax will increase from 19 to 25 in 2023. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. The following Capital Gains Tax rates apply.

The Office for Tax Simplification in their report suggested that Capital Gains Tax be aligned with Income Tax rates. Corporation tax and capital gains tax are central to the governments plan to help address the deficit that is on its way to 400bn 559bn this year. This could mean a switch to 20 per cent rates for people on the basic rate 40.

This is called entrepreneurs relief. One of the areas the government is looking to increase its tax collection from is capital gains. Alongside maintaining the Lifetime Allowance and Capital Gains Tax it is estimated the Treasury will raise some 204billion.

The Chancellor has long been rumoured be considering bringing capital gains tax rates more in line with income tax. Tue 26 Oct 2021 1157 EDT First published on Tue 26 Oct 2021 1100 EDT The government could raise an extra 16bn a year if the low tax rates on profits from shares and property were increased and. Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic.

Add this to your taxable income. Implications for business owners 19 January 2021 The Chancellor will announce the next Budget on 3 March 2021. Because the combined amount of 20300 is.

Capital gains tax rates for 2022-23 and 2021-22 If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Will capital gains tax rates increase in 2021. Bringing Capital Gains Tax rates more in line with Income Tax could mean a switch to 20 per cent rates for people on the basic rate 40. As announced on 7 September 2021 the government will legislate in Finance Bill 2021-22 to increase the rates of income tax applicable to dividend income by 125.

Gains from selling other assets are charged at 10 for. It is unlikely to be a controversial reform to the majority of the UK population given that. Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time.

For those who pay a higher rate of income tax or a trustee or business the rate is currently 28 per cent on gains from residential property and 20 per cent on gains from other chargeable assets. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. However this could mean implications for far more people with some.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. CGT is a tax on the profit when you sell an asset that has increased in value. OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. The dividend ordinary rate will. Unregulated Investment Schemes Remain a Threat to Investors.

A business owner who pays additional rate tax and who sells their business for a 3m gain could pay almost three times as much tax 135m against 500000 - if CGT is aligned to income tax. This time last year an entrepreneur could pay tax on the first 10m at 10 per cent following a disposal now its 1m at 10 per cent and the. 10 and 20 tax rates for individuals not including residential property and carried interest.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Its the gain you make thats taxed not the amount of. This measure reduces the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for chargeable gains except in relation to chargeable gains accruing on.

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Publish Your Passions Your Way Whether You D Like To Share Your Knowledge Experiences Or The Latest News Crea Blog Websites Blogging Guide Blogging Mistakes

Swiss Re Institute S Global Insurance Review 2017 Prices In Non Life Insurance And Reinsurance Expected To Increase Expectations Life Insurance Life

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Brazil Central Bank Head Goes All In With Bold Rate Hike Plan Central Bank Brazil Bank

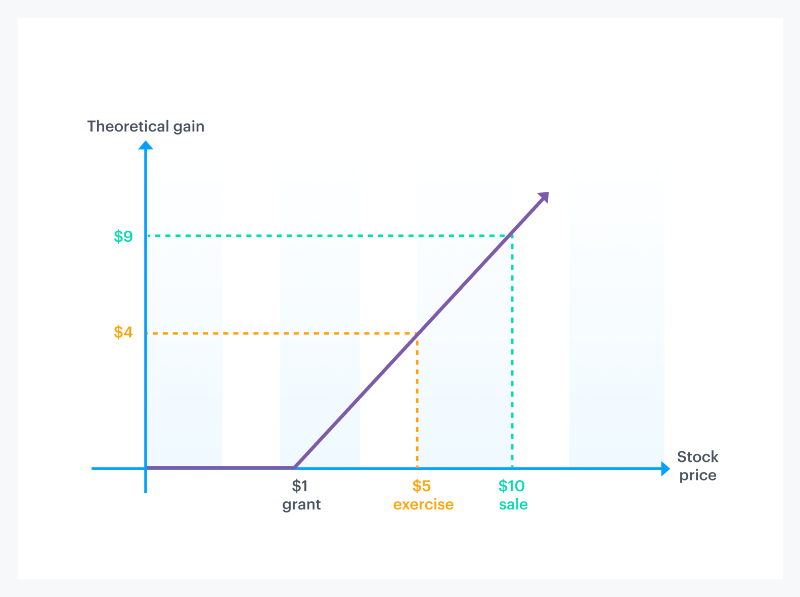

How Stock Options Are Taxed Carta

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Small Business Tax Deductions Tax Deductions

Capital Gains Yield Cgy Formula Calculation Example And Guide

California Equity Compensation Table Tax Credits State Tax Equity

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Investors Surge Into Vcts Ahead Of Dividend Tax Increase Financial Times

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

What Is Regressive Tax Raisin Uk

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Khrom Capital Killed It During The First Quarter Continuing Its Strong Track Record Here Are Their Favorite Stocks Investing Value Investing Value Stocks

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting

Uk S Patriotic Millionaires Call For Higher Taxes On Themselves Marketplace